Week of April 14, 2025 MARKET MOVEMENTS Tariffs Paused, Buy Everything! Last week, President Trump announced a 90-day pause on reciprocal tariffs, except for China, which saw its tariffs raised to 125%. This led to significant market reactions. The DOW surged 2,600 points, and the S&P 500 gained 200 points. Meanwhile, the yield on the US 10-year note fell to 4.40%, down from nearly 4.60% on Friday. Bonds Shrug off Cooler Inflation Reports Last week, interest rates rose despite weaker inflation readings from the CPI and PPI reports. U.S. bond funds saw heavy outflows, with investors pulling out $15.64 billion. The March PPI dropped by -0.4%, the largest monthly decline since April 2020, which may affect core-PCE estimates. Investors likely ignored these reports since they covered March inflation and didn't reflect the revised outlook after the tariff announcements. Calm Start to the Week Markets are calmer at the start of the holiday-shortened trading week. The Dow Jones is up o...

Posts

Showing posts from April, 2025

- Get link

- X

- Other Apps

The Real Estate Market Activities. Compass Silicon Valley, In March, we s aw a remarkable increase in both inventory and the number of closed transactions. Properties that sold for $200,000 or more above their asking prices skyrocketed from 38 to 66, reflecting a significant 73% rise compared to the previous month. Sunnyvale continued to be the standout market in our region, with 33 of these sales occurring i n th is city. Notably, more than half of the sales (37 properties) s natched at least $500,000 over their list prices, including an impressive Saratoga home that commanded a staggering $1 ,000,000 above its asking price. This surge in demand has out p aced the steady housing supply, exerting upward pressure on prices. Once again, the Silicon Valley residential housing market is defying expectations, even as higher mortgage rates have not come down as widely anticipated. ...

- Get link

- X

- Other Apps

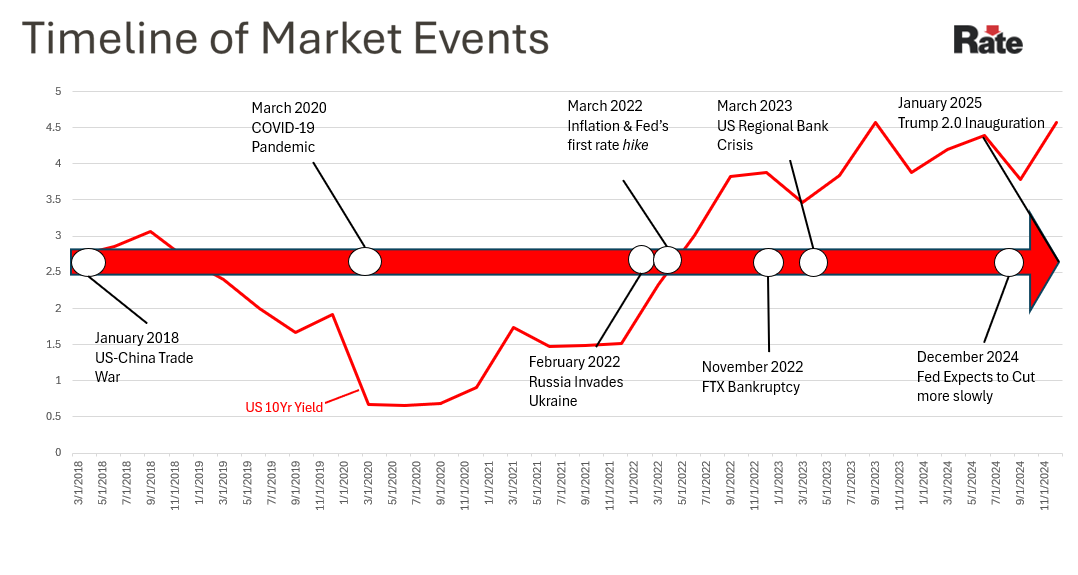

Mortgage Minute with Risha I had to share this. This chart clearly shows the impact of Key Market/Economic events on mortgage rates via the 10 Yr Treasury Note Yield. Mortgage rates trend to track the 10 yr Treasury Note Yield, which moves based on investor expectations about inflation, Fed policy and economic growth. When the Fed signals that rates will remain steady, it can create more certainty in the bond markets, which could stabilize mortgage rates. If investors interpret the pause as a sign that inflation remains stubborn, though it could keep Treasury yields higher, maintaining upward pressure on mortgage rates. A simple way to determine current mortgage rate is by adding 2.125/spread to the current yield and TADA.. you have an idea of the 30 yr rate on that day.. Please let know if yo want to upgrade, buy or sell a home or if you have any questions/concerns.